To transition out of an insurance career, you should explore alternative careers and job titles such as litigation specialist, underwriter, workers compensation specialist, or insurance agent. Leave the insurance industry by seeking opportunities in different sectors that align with your skills and interests.

Keep up with industry changes and stay informed about new career paths to ensure a smooth transition.

Reasons For Transitioning Out Of Insurance

Transitioning out of the insurance career can be a difficult decision, but it is one that many professionals make for various reasons. Below are several common reasons why individuals choose to leave the insurance industry.

Work-life Balance And Family Life

The demanding nature of the insurance industry often results in poor work-life balance, which can take a toll on family life. Insurance professionals frequently work long hours, including weekends and holidays, to meet tight deadlines and handle unexpected emergencies. This heavy workload leaves little time for personal and family commitments, leading to increased stress and strain on relationships.

Mental Stress

The insurance industry is notorious for its high levels of mental stress. Insurance professionals face the constant pressure of meeting targets, handling complex claims, and dealing with irate customers. The intense workload, tight deadlines, and ongoing pressure to perform can lead to burnout, anxiety, and other mental health issues. This constant stress takes a toll on both personal well-being and job satisfaction.

Lack Of Fulfillment

Many individuals find the insurance career lacking in fulfillment and purpose. While the industry plays a critical role in protecting individuals and businesses from financial risks, some professionals may feel disconnected from the direct impact of their work. The repetitive nature of tasks, limited scope for creativity, and a focus on profit margins rather than customer well-being may leave individuals feeling unfulfilled and seeking more meaningful career opportunities outside of insurance.

Career Progression Limitations

Insurance careers often have limitations when it comes to career progression. While there are opportunities for advancement within the industry, the path to higher-level positions can be limited and highly competitive. This lack of vertical mobility can be frustrating and demotivating for ambitious professionals looking to advance their careers. Additionally, the narrow focus of the insurance industry may limit opportunities to explore other areas of interest or develop new skills.

In conclusion, the reasons for transitioning out of the insurance industry are varied, but they often revolve around the desire for a better work-life balance, the need to reduce mental stress, the search for greater fulfillment, and the pursuit of new career progression opportunities. If you find yourself resonating with any of these reasons, it may be time to consider a change in your professional trajectory.

Credit: resume.io

Alternative Career Options

If you’ve decided to transition out of the insurance industry, you may be wondering about alternative career options. Fortunately, there are several professions that offer transferable skills and opportunities for growth.

Underwriter

An underwriter evaluates and assesses risks for insurance companies. They analyze information and determine the appropriate coverage and premiums. As an underwriter, you will need strong analytical and decision-making skills. This career path offers opportunities for advancement and specialization.

Claims Adjuster

A claims adjuster investigates and evaluates insurance claims, determining coverage and settlement amounts. This role requires excellent communication and negotiation skills, as well as attention to detail. Claims adjusters can specialize in various types of insurance, such as auto, property, or liability.

Financial Representative

A financial representative provides financial planning and investment advice to clients. With your background in insurance, you can leverage your knowledge to help individuals and businesses manage their financial portfolios. This career path requires strong interpersonal skills and a deep understanding of financial products and markets.

Benefits Consultant

A benefits consultant helps companies design and manage employee benefit programs, such as health insurance, retirement plans, and wellness initiatives. With your expertise in insurance, you can guide employers in selecting the best coverage options for their workforce. This role requires strong analytical and problem-solving skills.

Litigation Specialist

A litigation specialist assists with legal cases related to insurance claims. They review evidence, provide expert opinions, and support insurance companies in court proceedings. This role requires a solid understanding of insurance law and regulations. Strong research and analytical skills are essential in this field.

Workers Compensation Specialist

A workers compensation specialist focuses on managing workplace injury claims and ensuring compliance with state regulations. They work closely with injured employees, healthcare professionals, and insurance carriers. This career path requires strong communication skills and a thorough understanding of workers compensation laws.

Insurance Agent

As an insurance agent, you can leverage your industry knowledge and sales skills to assist individuals and businesses in selecting the right insurance policies. Whether it’s auto, home, or life insurance, your expertise in the field will allow you to provide valuable guidance to clients. This role requires excellent customer service and networking abilities.

Preparing For A Career Change

Transitioning out of an insurance career can be daunting, but with proper preparation, it can be a smooth process. Research alternative careers and skillsets that align with your interests, stay updated with industry changes, and consider networking and upskilling to make a successful career change.

Staying Up-to-date With Industry Changes

In order to successfully transition out of the insurance career and into a new field, it is crucial to stay up-to-date with industry changes. This means keeping an eye on new trends, technologies, and regulations that may affect your desired career path. One way to do this is by subscribing to industry newsletters or joining professional associations related to your new field. These resources can provide valuable insights and keep you informed about the latest developments in your industry.

Identifying Transferable Skills

Identifying your transferable skills is an important step when preparing for a career change. These are skills that you have acquired in your insurance career that can be applicable to a variety of industries. Some transferable skills common in the insurance industry include strong communication skills, problem-solving abilities, analytical thinking, and attention to detail. By identifying and highlighting these skills, you can effectively convey your value to potential employers in your desired field.

Seeking Additional Training Or Education

In some cases, seeking additional training or education may be necessary to transition into a new career. This could involve pursuing a certification program or enrolling in courses that will help you gain the relevant skills and knowledge needed for your new field. Research the specific requirements of your desired career and invest in the necessary training or education to increase your chances of success.

Networking And Building Connections

Networking and building connections can play a crucial role in transitioning out of the insurance career. Attend industry events, workshops, and conferences related to the field you are interested in. Utilize professional networking platforms such as LinkedIn to connect with individuals working in your desired industry. By networking with experienced professionals, you can gain valuable insights, advice, and potentially even job opportunities.

Exploring Related Industries

When preparing for a career change, it is important to explore related industries that align with your skills and interests. Research companies and job roles that may offer opportunities for a smooth transition out of the insurance field. Look for industries that value your insurance expertise and consider how your skills can be applied in a different context. By exploring related industries, you may discover new career paths that you had not considered before.

Tips For A Successful Career Change

Transitioning out of an insurance career can be daunting, but with the right tips, you can successfully make the change. Focus on networking, updating your skills, and exploring alternative career paths to ensure a smooth transition.

Assessing Personal Goals And Interests

Before making a career change, it’s essential to assess your personal goals and interests. Take the time to reflect on what truly drives and motivates you. Consider your passions, strengths, and values to determine the direction you want your career to take.

Reflecting on your personal goals and interests will help you gain clarity on the type of work that aligns with your values and brings you fulfillment. It will also allow you to identify any skills or knowledge gaps that you may need to address during your career transition.

Creating A Transition Plan

Once you have a clear understanding of your personal goals and interests, it’s time to create a transition plan. A transition plan will provide you with a roadmap to achieve your career change smoothly and successfully.

Start by setting clear, actionable goals and outlining the steps you need to take to reach them. Break down your goals into smaller milestones, allowing you to track your progress and adjust your plan as needed.

Identify the skills and qualifications required for your desired career path, and seek out opportunities to acquire them. This may include taking courses, obtaining certifications, or gaining practical experience through internships or volunteering.

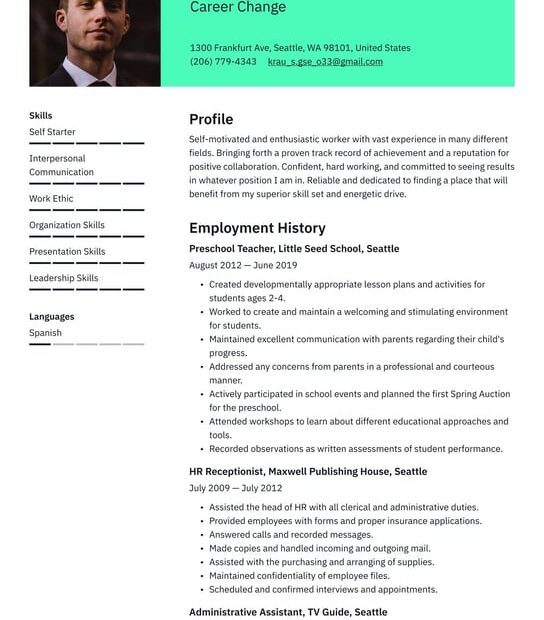

Building A Strong Resume And Cover Letter

When transitioning to a new career, having a strong resume and cover letter is crucial. These documents will serve as your first impression to potential employers, highlighting your relevant skills and experiences.

Start by tailoring your resume to showcase your transferable skills. Highlight any achievements or experiences that demonstrate your ability to thrive in a new industry. Use strong action verbs and quantify your accomplishments whenever possible.

In your cover letter, explain why you’re transitioning careers and highlight the transferable skills and experiences that make you a valuable candidate. Show enthusiasm for the new industry and convey a genuine passion for the work you’re pursuing.

Developing A Professional Network

Building a strong professional network is instrumental in a successful career change. Connect with professionals in your desired industry through online platforms such as LinkedIn or industry-specific forums and associations.

Attend industry events, conferences, and networking sessions to meet like-minded individuals and expand your network. Actively engage with your contacts by sharing relevant content, offering support and assistance, and seeking advice or mentorship.

Having a robust network can provide you with valuable insights, job leads, and potential referrals. It can also help you gain a deeper understanding of the industry and create opportunities for collaboration and professional growth.

Making A Smooth Transition

Transitioning to a new career can be challenging, but with careful planning and execution, you can make the process smooth and successful. Stay open-minded and adaptable, embracing the changes and opportunities that come your way.

Continuously update your skills and knowledge, staying up-to-date with industry trends and advancements. Seek out learning opportunities through online courses, workshops, and industry-specific certifications.

Be proactive in your job search, reaching out to potential employers and attending job fairs or industry-specific career events. Leverage your network to uncover hidden job opportunities and gain insights into the hiring process.

Lastly, maintain a positive mindset and remember that a career change is an exciting opportunity for growth and personal development. Embrace the challenges and uncertainties that come with transitioning to a new industry, knowing that your determination and hard work will pay off in the long run.

Navigating The Career Change Process

Transitioning out of an insurance career can be a challenging and daunting process. However, with the right strategies and mindset, it is possible to navigate this career change successfully. In this section, we will explore some essential aspects to consider when transitioning out of the insurance industry.

Overcoming Challenges And Obstacles

Transitioning out of the insurance industry can present various challenges and obstacles. It is important to tackle them head-on and find solutions to overcome them. Some common challenges may include:

- Acquiring new skills and knowledge

- Building a new professional network

- Identifying suitable job opportunities

- Addressing financial concerns during the transition period

To overcome these challenges, you can:

- Seek specialized training or certification programs to enhance your skills and adaptability.

- Utilize online platforms and networking events to connect with professionals from your desired industry.

- Explore job search platforms and consult career counselors to find potential career opportunities.

- Plan and save finances to ensure a smooth transition without unnecessary stress.

Seeking Guidance And Support

During a career change, seeking guidance and support is crucial to gain valuable insights and direction. Consider the following avenues for assistance:

- Mentorship: Connect with professionals who have successfully transitioned to your desired industry for guidance and advice.

- Professional Associations: Join industry-specific associations to access resources, workshops, and networking opportunities.

- Career Coaches: Engage with career coaches who specialize in helping individuals transition between industries.

Adjusting To New Industry Norms

Each industry has unique norms and practices. Adapting to these norms will ensure a successful transition. Here’s how you can adjust:

- Industry Research: Dive deep into industry-specific trends, terminologies, and best practices to familiarize yourself with the new landscape.

- Networking: Attend industry events and engage in conversations to understand the current happenings and build connections.

- Learning from Peers: Connect with individuals working in your desired industry to gain insights and learn from their experiences.

Maintaining A Positive Mindset

A positive mindset is crucial during a career change. It will help you stay motivated and focused on reaching your goals. Consider these strategies:

- Embrace Change: View the transition as an opportunity for growth and personal development.

- Practice Self-Care: Maintain a healthy work-life balance and engage in activities that help reduce stress.

- Celebrate Small Wins: Acknowledge and celebrate the progress you make during the transition, no matter how small it may seem.

Continuing Professional Development

Continuous learning and development are essential for a successful career change. Here’s how you can ensure your professional growth:

- Attend Training Workshops: Participate in industry-related training workshops and seminars to stay updated with the latest knowledge and skills.

- Pursue Additional Certifications: Consider obtaining certifications that are relevant to your new career path to enhance your credibility.

- Join Online Communities: Engage in online forums and communities to connect with professionals and gain valuable insights.

By actively engaging in these strategies, you can smoothly navigate the career change process and transition successfully into your new industry.

Credit: m.facebook.com

Credit: m.facebook.com

Frequently Asked Questions Of How To Transition Out Of Insurance Career

What Is A Good Career Change For An Insurance Adjuster?

A good career change for an insurance adjuster could be becoming a litigation specialist, underwriter, workers compensation specialist, or insurance agent. These professions have similar skills and knowledge to that of an insurance adjuster.

Why Do People Leave Insurance Jobs?

People leave insurance jobs due to work-life balance, family life, and mental stress, as identified in a study.

Why I Quit Being An Insurance Agent?

I quit being an insurance agent due to the lack of work-life balance, the mental stress, and the desire for a new career path.

Is Insurance A Stable Career?

Insurance is generally considered a stable career due to the consistent demand for insurance products and services.

Conclusion

Transitioning out of an insurance career can be a daunting task, but with a little planning and the right approach, it can lead to exciting new opportunities. In this blog post, we discussed several alternative career paths to consider, such as becoming a litigation specialist, underwriter, workers compensation specialist, or insurance agent.

We also highlighted the common reasons why people leave the insurance industry, such as work-life balance, family life, and mental stress. Remember to stay current on industry changes and keep your options open as you navigate this transition. Good luck on your new career path!

- How Much Does a Ford 9N Tractor Weigh - May 20, 2024

- How Many of My Exact Car were Made: Uncovering the Rarity - May 20, 2024

- How to Find Out What Someone Drives: Discover the Truth - May 20, 2024