If you have gap insurance on your totaled car, you do not have to make payments on it. Gap insurance covers the remaining balance on your car loan if your car is deemed a total loss and the insurance payout does not cover the full amount you owe.

What Is Gap Insurance?

Gap insurance, also known as loan/lease gap coverage, is an optional car insurance coverage that offers financial protection in the event of a total loss or theft of your vehicle. It helps bridge the gap between the depreciated value of your car and the balance you owe on your auto loan or lease. This means that even if your car is deemed a total loss and the insurance payout falls short of your outstanding loan, gap insurance will cover the difference, ensuring you won’t be left making payments for a vehicle you no longer possess.

Definition Of Gap Insurance

Gap insurance, short for Guaranteed Asset Protection insurance, is a policy that protects car owners from financial loss when the insurance payout for a total loss or theft falls short of the amount owed on a loan or lease.

How Gap Insurance Works

When you purchase a car, its value starts depreciating as soon as you drive off the lot. In the unfortunate event that your car is totaled or stolen, your auto insurance policy will typically only cover the actual cash value of the vehicle at the time of the incident. However, if you still owe more on your loan or lease than what the insurance payout covers, you’ll be left with a remaining balance.

Gap insurance steps in to cover this gap between the insurance payout and your outstanding loan or lease balance. It ensures that you won’t have to continue making payments on a car you no longer have while also helping you avoid the financial burden of paying off a loan for a vehicle that no longer exists.

Benefits Of Gap Insurance

Having gap insurance offers several benefits:

- Financial Protection: Gap insurance provides peace of mind by protecting you from potential financial strain in the event of a total loss or theft of your car.

- No More Payments: With gap insurance, you won’t be stuck making payments for a vehicle that’s no longer in your possession.

- Loan Balance Coverage: Gap insurance covers the difference between the depreciated value of your car and the amount you still owe on your loan or lease.

- Flexibility: Gap insurance is available for both leased and financed vehicles, ensuring comprehensive coverage options regardless of your car ownership situation.

- Lower Risk: By reducing the financial risk associated with a total loss or theft, gap insurance allows you to focus on other important matters during a difficult time.

Overall, gap insurance is a valuable add-on to your car insurance policy, providing you with the necessary financial protection and peace of mind in situations where your car is deemed a total loss or stolen.

Does Gap Insurance Pay Off My Loan?

Gap insurance is an optional coverage that can pay off your auto loan if your car is declared a total loss and you still owe more than its depreciated value. It helps bridge the “gap” between what you owe and what your car is worth.

Explaining Gap Insurance Coverage

Gap insurance, also known as “loan/lease gap coverage,” is an optional car insurance coverage that can be extremely helpful in certain situations. It works by paying off your auto loan if your car is totaled or stolen and you owe more than the car’s depreciated value. Gap insurance covers the difference between what you owe on the car and its actual cash value, ensuring that you don’t have to continue making payments for a vehicle you no longer possess.Situations Where Gap Insurance Doesn’t Pay

While gap insurance provides valuable coverage, there are certain situations where it may not pay off your loan. For instance, if the car is not considered a total loss, gap insurance won’t cover the remaining balance. Additionally, if the policy was canceled before the loss occurred, gap insurance coverage won’t come into effect. It’s important to understand the specific terms and conditions of your gap insurance policy to know exactly when it will or will not pay off your loan.Refund Options With Gap Insurance

If you find yourself in a situation where you don’t need to use your gap insurance coverage, such as your car insurance payout fully covering the loan balance, you may be eligible for a refund. However, this is only possible if you don’t file a gap insurance claim. In such cases, you can cancel the policy and request a refund from your gap insurance provider. It’s always a good idea to consult with your insurance company to understand the refund process and any applicable fees or requirements before making a decision. In conclusion, gap insurance is designed to protect you from financial strain if your car is totaled or stolen. It covers the difference between what you owe on the car and its actual cash value, ensuring that you don’t have to make payments for a vehicle you no longer possess. However, it’s important to be aware of the situations where gap insurance may not pay off your loan and the refund options available if you don’t need to use the coverage.How Does Gap Insurance Work On A Totaled Car?

Have you ever wondered what happens when your car is totaled and you still have payments to make? This is where Gap insurance comes into play. Gap insurance is a type of coverage that helps bridge the gap between the insurance payout for your totaled car and the remaining loan balance. In this article, we will delve into how Gap insurance works on a totaled car, including the coverage it provides and whether or not you need it.

Covering The Difference Between Insurance Payout And Loan Value

One of the key factors that Gap insurance covers is the difference between the insurance payout and the remaining loan balance. When your car is totaled, your insurance company will typically pay you the actual cash value (ACV) of your car at the time of the accident. However, this payout amount may be less than what you still owe on your car loan. This is where Gap insurance steps in, covering the difference so that you don’t have to make payments for a vehicle you no longer possess.

Average Vehicle Gap Insurance Coverage

The average gap insurance coverage can vary depending on factors such as the type of vehicle, loan amount, and loan term. On average, Gap insurance coverage ranges from 25% to 50% of the ACV of the vehicle. For example, if the ACV of your car is $20,000 and you have 50% Gap insurance coverage, then your Gap insurance policy would cover $10,000 of the remaining loan balance.

Do You Need Gap Insurance?

Whether or not you need Gap insurance depends on your specific circumstances. Here are a few factors to consider:

- Loan amount: If you have a large loan amount or a longer loan term, the depreciation of your car may outpace the rate at which you are paying off your loan. In this case, Gap insurance can be beneficial.

- Loan-to-value ratio: If your car loan exceeds the value of your car, Gap insurance can help protect you from owing money on a car you no longer have.

- Lease agreement: If you are leasing a car, Gap insurance is usually required as part of the lease agreement.

- Resale value: If your car has a high resale value, you may not need Gap insurance as the insurance payout is likely to cover the remaining loan balance.

It is important to assess your individual situation and consult with your insurance provider to determine if Gap insurance is necessary for you.

In conclusion, Gap insurance can provide valuable coverage in the event of a totaled car. It covers the difference between the insurance payout and the remaining loan balance, ensuring that you don’t have to make payments on a car you no longer possess. The average Gap insurance coverage typically ranges from 25% to 50% of the actual cash value of the vehicle. Whether or not you need Gap insurance depends on factors such as your loan amount, loan-to-value ratio, lease agreement, and resale value. Assessing your individual circumstances and consulting with your insurance provider will help you make an informed decision.

:max_bytes(150000):strip_icc()/do-drivers-really-need-gap-insurance.asp_v1-424595465de34273be8ac3c51fc6232b.png)

Credit: www.investopedia.com

What To Do If Your Car Is Totaled

When your car is totaled, it can be a stressful and confusing situation. Understanding your options and knowing what steps to take can help alleviate some of that stress. If you have gap insurance, you may be wondering if you still have to make payments on your totaled car. In this section, we’ll explore what to do if your car is totaled and how gap insurance plays a role in the process.

Understanding Your Options After A Total Loss

After your car is declared a total loss, you will need to navigate through a few options. These options may vary depending on your insurance company and the specifics of your policy. Here are some common options after a total loss:

- Accepting the settlement: In most cases, the insurance company will offer you a settlement based on the actual cash value (ACV) of your car. If this amount is enough to pay off your loan, you can accept the settlement and use the funds to pay off your car loan.

- Using your gap insurance: If you owe more on your car loan than the ACV of your car, your gap insurance comes into play. Gap insurance covers the difference between the ACV and the amount you owe, allowing you to pay off your loan balance.

- Keeping your totaled car: In some cases, you may have the option to keep your totaled car. However, the insurance payout will still be based on the ACV, and you will need to consider the cost of repairs and potential salvage fees.

Common Questions About Car Totals

When your car is totaled, you may have several questions about the process and your options. Here are some common questions that arise:

- Will I still have to make loan payments on a totaled car? If the settlement amount or your gap insurance covers the remaining balance on your car loan, you will not have to make further payments. However, if there is a remaining balance after the settlement, you may still need to continue making payments.

- What happens if I don’t have gap insurance? If you do not have gap insurance, you will be responsible for paying off the remaining loan balance even if your car is totaled. This can leave you financially burdened, especially if your car’s ACV is significantly lower than the amount you owe.

- Can I get a refund for my gap insurance after a total loss? If you did not file a gap insurance claim and your car insurance payout covers the loan balance, you can cancel your gap insurance policy and request a refund.

Gap Insurance’s Role In Total Loss

Gap insurance plays a crucial role in a total loss situation. If you owe more on your car loan than the ACV of your car, gap insurance coverage can help bridge that gap and relieve you of the financial burden of a remaining loan balance. It ensures that you do not have to continue making payments on a car that you no longer possess.

Refunds And Gap Insurance

If you have gap insurance, you might not need to make payments on a totaled car. Gap insurance covers the difference between what you owe on your car loan and the car’s actual cash value, so you don’t have to keep paying for a vehicle you no longer possess.

Possibility Of Refunds With Gap Insurance

If you have gap insurance and your car is totaled, you may be wondering if you still have to make payments on the vehicle. Luckily, with gap insurance, you may not have to. Gap insurance is designed to cover the remaining balance on your car loan if your car is deemed a total loss and you owe more than the car’s depreciated value. This means that if you have gap insurance and your car is totaled, you won’t be stuck making payments on a car that you no longer possess.Refund Process And Conditions

If your car is totaled and you have gap insurance, there is a possibility of getting a refund. However, there are certain conditions that need to be met in order to qualify for a refund. Firstly, if you have already filed a gap insurance claim, you will not be eligible for a refund. The purpose of gap insurance is to cover the difference between what you owe on your car loan and the actual cash value of the vehicle, so if the gap insurance has already been utilized, you won’t be able to get a refund. In order to get a gap insurance refund, your car insurance payout must cover the loan balance in full. If this is the case and you no longer need to use the gap insurance, you can cancel the policy and request a refund. Keep in mind that the refund process may vary depending on your gap insurance provider, so it’s important to contact them directly to understand their specific requirements and procedures for obtaining a refund. To summarize, if you have gap insurance and your car is totaled, you have the potential to receive a refund. However, this is contingent on not filing a gap insurance claim and having your car insurance payout cover the loan balance in full. It’s always a good idea to reach out to your gap insurance provider to ensure you understand their refund process and any specific conditions that apply.

Credit: www.tdi.texas.gov

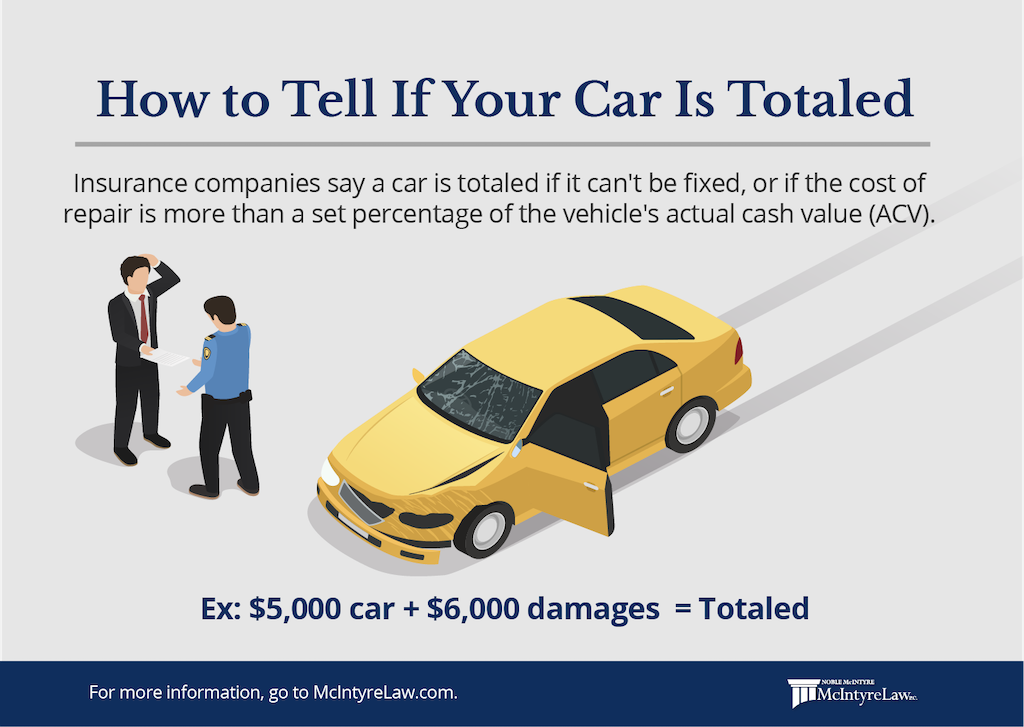

Credit: mcintyrelaw.com

Frequently Asked Questions For Do I Still Have To Make Payments On A Totaled Car With Gap Insurance

Will Gap Insurance Pay Off My Loan?

Gap insurance is designed to pay off your auto loan if your car is totaled or stolen and you owe more than the car’s value. It covers the difference between the amount you owe and the depreciated value of the car.

Why Didn T Gap Pay Off My Car?

Gap insurance only pays off your car if it’s a total loss or stolen and you owe more than its value. If your car isn’t a total loss or if your gap insurance policy was canceled before the loss occurred, Gap insurance won’t pay off your car.

Can I Get A Refund From Gap Insurance After Total Loss?

Yes, you can get a refund from gap insurance after a total loss if you don’t file a claim. If your car insurance payout covers your loan balance and you no longer need gap insurance, you can cancel the policy and request a refund.

How Does Gap Insurance Work On A Car?

Gap insurance is an optional coverage that pays off your car loan if it’s totaled or stolen and you owe more than its value. It covers the difference between what you owe and the car’s actual cash value, so you don’t have to make payments for a vehicle you no longer possess.

Conclusion

In the event of a totaled car with gap insurance, you may still be required to make payments. Gap insurance is designed to cover the difference between the car’s value and the amount owed on the loan, but it does not eliminate the need for payments.

It is important to check with your specific gap insurance policy to understand the terms and conditions. Remember to always communicate with your insurance provider to ensure you have a clear understanding of your financial obligations.

- How to Diagnose Bad Strut Mounts: Expert Tips for Quick Fixes - May 16, 2024

- How to Bypass Blower Motor Relay: 7 Expert Techniques - May 16, 2024

- How to Easily Check Ecu Ground: Essential Steps for Optimal Performance - May 16, 2024