To ensure eligibility for a settlement, you typically have to report a car accident to your insurance company within 30 days of the incident. Failing to do so may result in a denial of your claim.

It is important to promptly inform your insurer to initiate the claims process and provide the necessary documentation. Remember to thoroughly review your insurance policy for any specific reporting requirements or timeframes as they may vary by state and insurer.

Understanding The Importance Of Reporting A Car Accident

It is crucial to understand the importance of promptly reporting a car accident to your insurance company. Failure to do so within the set time limit can result in your claim being denied. Make sure to report the accident as soon as possible to ensure a smooth claims process.

Why Reporting A Car Accident Is Crucial

Understanding the importance of reporting a car accident is vital for both your own financial well-being and for ensuring a smooth claims process with your insurance company. When you report a car accident to your insurance company in a timely manner, you are taking the necessary steps to protect yourself and your rights as a policyholder.

- Promptly reporting a car accident allows your insurance company to begin the claims process as soon as possible. This is important because certain damages or injuries may worsen over time, and the longer you wait to report the accident, the more difficult it may be to establish a clear link between the accident and the resulting damage.

- Reporting a car accident promptly also demonstrates your cooperation and honesty to your insurance provider. Failing to report an accident promptly may raise suspicions about the validity of your claim, potentially resulting in delayed or denied coverage.

Potential Consequences Of Not Reporting

The consequences of not reporting a car accident to your insurance company can be significant. Ignoring the need to report an accident can result in:

- Loss of coverage: If you fail to report an accident within the specified timeframe outlined in your policy, your insurance company may refuse to cover your claim. This means you will have to bear the financial burden of repairing your vehicle or paying for medical expenses on your own.

- Legal issues: In many states, failing to report a car accident to your insurance company within a certain timeframe is a violation of the law. This can result in penalties such as fines, license suspensions, or even criminal charges.

- Negative impact on future claims: Choosing not to report an accident can also have long-term implications. If you are involved in another accident in the future, your insurance company may view your failure to report the previous accident as a red flag, making it more difficult for you to obtain coverage or fair compensation.

The Role Of Insurance Companies In Accident Reporting

Insurance companies play a crucial role in the accident reporting process. When you report a car accident to your insurance company, they will:

- Document the details of the accident: Your insurance company will collect information about the accident, including the date, time, location, and parties involved. This documentation will help establish the facts of the accident and support your claim.

- Assess the damage: Insurance adjusters will evaluate the extent of the damage to your vehicle and any other property affected by the accident. This evaluation is essential for determining the appropriate compensation.

- Manage the claims process: Your insurance company will guide you through the claims process, providing you with the necessary forms and instructions. They will also communicate with the other party’s insurance company, if applicable, to negotiate a fair settlement on your behalf.

Overall, understanding the importance of promptly reporting a car accident to your insurance company is crucial for protecting your rights, ensuring proper coverage, and keeping your record in good standing. By following the guidelines set by your insurance policy, you can ensure a smoother claims process and avoid potential complications or penalties down the road.

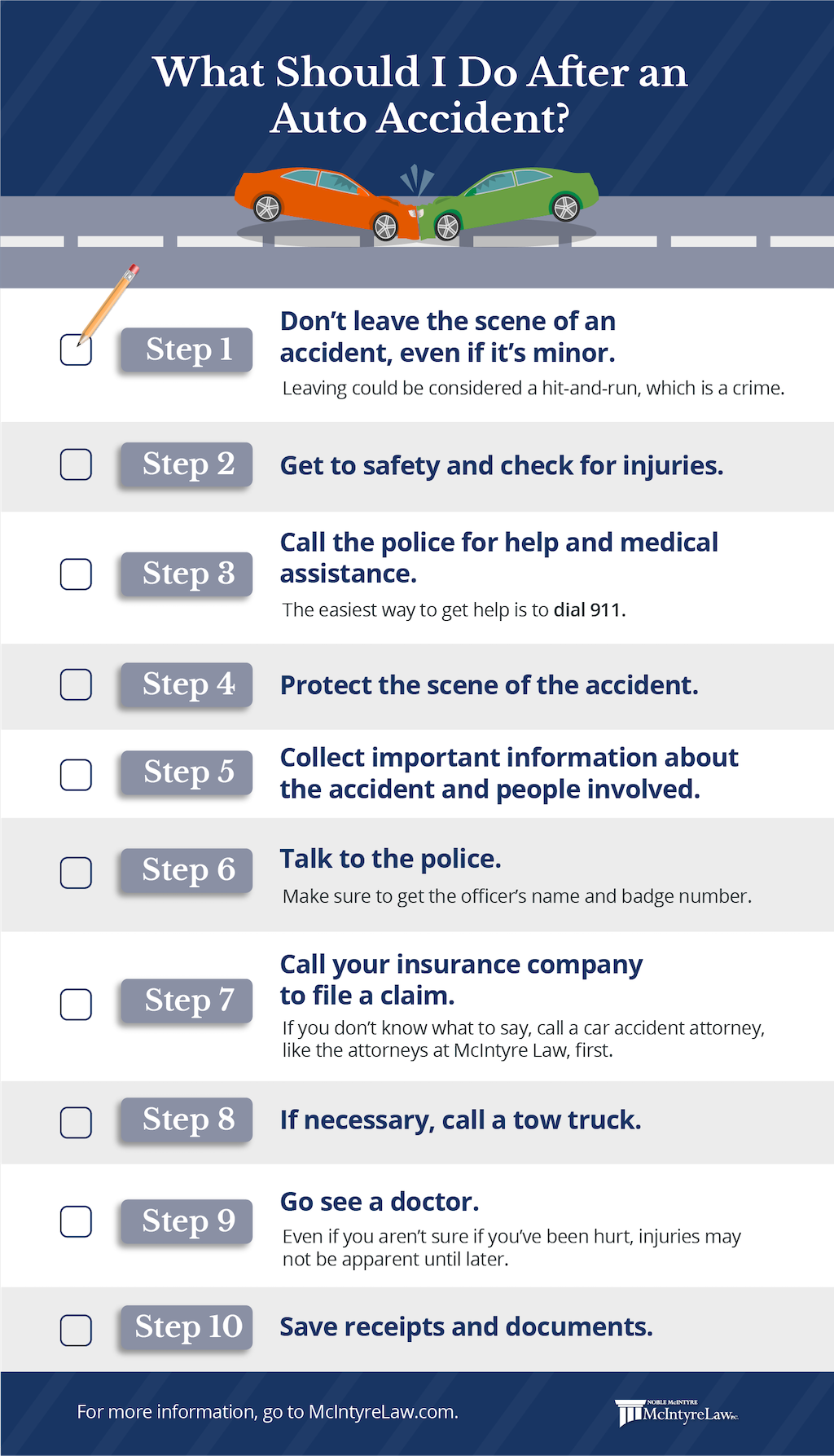

Credit: mcintyrelaw.com

Time Frame For Reporting A Car Accident

You have a limited time frame to report a car accident to your insurance company. In Texas, for example, the statute of limitations is two years from the date of the accident. It is important to file a claim within this time window to be eligible for a settlement.

State-specific Reporting Requirements

Each state has specific reporting requirements when it comes to reporting a car accident to your insurance company. It is important to understand these requirements to ensure that you comply with the regulations in your state. Here are some examples of state-specific reporting requirements:

| State | Reporting Deadline |

|---|---|

| Texas | 10 days |

| Florida | Within 10 days if there are injuries or fatalities |

| California | Within 10 days if there are injuries or property damage exceeding $1,000 |

Overview Of Common Reporting Deadlines

While reporting deadlines may vary depending on the state, there are some common time frames that most insurance companies expect you to adhere to. Here is an overview of the common reporting deadlines:

- Immediately after the accident: It is always best to report the accident to your insurance company as soon as possible. This allows them to start the claims process promptly and ensures that all relevant details are fresh in your mind.

- Within 24 hours: In many cases, insurance companies require you to report the accident within 24 hours. This gives them enough time to gather information and initiate the necessary procedures.

- Within a few days: If you are unable to report the accident immediately or within 24 hours, make sure to inform your insurance company within a few days. Delaying the report may cause complications and could potentially affect your claim.

Exceptions To The Reporting Time Frame

While it is crucial to report a car accident to your insurance company within the specified time frame, there are some exceptions that you should be aware of. These exceptions may vary from state to state and can depend on factors such as the severity of the accident and the extent of injuries involved. Here are a few common exceptions:

- Medical emergencies: If you or someone else involved in the accident requires immediate medical attention, prioritize seeking medical help first. Once the situation is stable, notify your insurance company as soon as possible.

- Unforeseen circumstances: In some cases, unforeseen circumstances may prevent you from reporting the accident within the designated time frame. This could include situations like being hospitalized or incapacitated. If you find yourself in such a situation, make sure to report the accident to your insurance company as soon as you are able to.

- Hit-and-run accidents: If you are involved in a hit-and-run accident, the reporting requirements may differ. Some states require you to report the accident to the police within a certain time frame, while others may have different reporting requirements for hit-and-run incidents. It is essential to familiarize yourself with your state’s specific regulations in such cases.

Knowing the time frame for reporting a car accident to your insurance company is essential to ensure a smooth claims process. By understanding state-specific reporting requirements, common reporting deadlines, and exceptions to the reporting time frame, you can fulfill your obligations and protect your interests.

Reporting A Car Accident To Your Insurance Company

In Texas, it is important to report a car accident to your insurance company within 30 days to ensure eligibility for a settlement. Filing a police report and reporting any injuries within the two-year statute of limitations is also crucial.

Contacting Your Insurance Company

If you’ve been involved in a car accident, one of the first things you should do is contact your insurance company. Reporting the accident in a timely manner is crucial to ensure a smooth claims process. Most insurance companies require you to report the accident within a certain timeframe, which can vary depending on the state you live in and your specific policy. It’s important to familiarize yourself with the reporting requirements of your insurance company to avoid any potential issues.

Information To Provide During The Report

When contacting your insurance company to report a car accident, be prepared to provide them with necessary information. This includes details like the date, time, and location of the accident, the names and contact information of all parties involved, and a description of how the accident occurred. Additionally, your insurance company may ask for information about any injuries sustained, damages to vehicles, and any police reports or witness statements that were gathered at the scene. Providing accurate and detailed information will help facilitate the claims process and ensure that your insurance company has all the necessary information to assess the situation properly.

Documentation Required For The Claim

When filing a car insurance claim, certain documentation will be required to support your case. This documentation often includes copies of the police report, photos or videos of the accident scene and damages, medical records and bills if there were any injuries, and any other relevant documents like repair estimates or receipts for out-of-pocket expenses. It’s important to keep thorough and organized documentation throughout the claims process to ensure that you have the necessary evidence to support your claim and maximize your chances of a successful outcome.

Credit: kainelaw.com

Legal Requirements And Obligations

When you’re involved in a car accident, it’s crucial to report the incident to your insurance company as soon as possible. Failure to do so may result in complications when it comes to filing an insurance claim and receiving compensation for damages. In this article, we will discuss the legal requirements and obligations regarding reporting a car accident to your insurance company.

State Laws Regarding Accident Reporting

State laws regarding accident reporting vary, and it’s important to understand the requirements specific to the jurisdiction where the accident occurred. For example, in some states, such as Texas, there is no specific deadline for reporting accidents to your insurance company. However, it is always advisable to report the accident as soon as possible, ideally within 30 days.

Legal Obligations In Different Jurisdictions

In different jurisdictions, there may be specific legal obligations regarding reporting car accidents to your insurance company. It is essential to familiarize yourself with these requirements to ensure compliance and prevent any potential legal issues.

Consequences Of Failing To Meet Legal Requirements

Failure to meet the legal requirements of reporting a car accident to your insurance company can have severe consequences. These consequences may include:

- Delayed or denied insurance claims: Failing to report the accident within the specified timeframe may result in your insurance claim being delayed or denied.

- Loss of coverage: Your insurance policy may have specific provisions stating that non-compliance with the reporting requirements can lead to loss of coverage.

- Legal penalties: In some jurisdictions, failing to report a car accident may result in legal penalties, such as fines or even license suspension.

Therefore, it is essential to meet the legal obligations and promptly report any car accident to your insurance company to avoid these potential consequences.

Steps To Take After A Car Accident

After a car accident, it is important to report the incident to your insurance company as soon as possible. The timeframe for reporting may vary depending on your state, but it is generally recommended to report the accident within a few days to ensure a smooth claims process.

Ensuring Safety At The Accident Scene

After a car accident, the first and most important step is to ensure everyone’s safety at the scene. If possible, move the vehicles to a safe location away from traffic to prevent any further accidents or injuries.

- Check yourself and passengers for any injuries and call emergency services if needed.

- If it is safe to do so, turn on hazard lights and set up flares or warning triangles to alert other motorists.

Collecting Necessary Information

Gathering the necessary information is crucial for reporting the accident to your insurance company. This information will help facilitate the claims process and ensure a smooth resolution.

- Exchange personal and insurance details with the other driver(s) involved, including names, contact numbers, addresses, and insurance policy information.

- Note down the make, model, and license plate numbers of all vehicles involved in the accident.

- Take pictures of the accident scene, including the vehicles’ positions, damages, and any relevant road markings or signs.

Seeking Medical Attention

Even if you believe your injuries are minor, seeking medical attention is essential to ensure your well-being and document any injuries sustained during the accident.

- Call an ambulance or visit a doctor to receive a proper medical evaluation, especially if you experience any pain or discomfort.

- Keep all medical records and receipts related to your treatment, as this will be important for insurance claims later on.

Preserving Evidence For Insurance Claims

Preserving evidence is crucial for filing an insurance claim and proving fault. By following these steps, you can ensure that you have the necessary evidence to support your claim.

- Obtain copies of the police report, if one was filed at the scene of the accident.

- Collect any witness statements and their contact information to support your version of events.

- Keep records of any expenses related to the accident, such as towing fees, rental car costs, and medical bills.

- Notify your insurance company as soon as possible and provide them with all the necessary information and documentation.

Credit: florinroebig.com

Frequently Asked Questions On How Long Do You Have To Report A Car Accident To Your Insurance Company

How Long Do You Have To File A Police Report After A Car Accident In Texas?

In Texas, you have two years from the date of the car accident to file a police report. It’s important to report the accident as soon as possible to ensure eligibility for any settlement.

How Long After Car Accident Can You Claim Injury In Texas?

You have two years from the date of the car accident to claim injury in Texas. Make sure to file any personal injury claims within this timeframe to be eligible for a settlement.

How Long Can A Car Insurance Claim Stay Open In Texas?

In Texas, a car insurance claim can stay open until it is settled by the insurance company.

Do I Pay Excess If Not At Fault?

If you are not at fault, you still have to pay the excess when making a claim on your insurance policy. However, if it is proven that the accident was the other person’s fault and their insurer covers the full cost, you may be able to recover the excess amount.

Conclusion

To ensure your car accident claim is handled smoothly, it’s crucial to report the incident to your insurance company as soon as possible. While there may not be a strict deadline, it’s best to contact them promptly. Keep in mind that different states may have different timeframes for reporting accidents, so it’s essential to familiarize yourself with your local regulations.

By reporting the accident promptly, you can streamline the claims process and ensure a timely resolution. Don’t delay – report your car accident to your insurance company today.