Faking car insurance is illegal and can lead to severe penalties. It is not recommended to engage in such fraudulent activities.

Introducing fake car insurance is illegal and can have serious consequences. It is important to have legitimate and valid car insurance coverage to protect yourself and others in case of any unfortunate incidents. Attempting to fake car insurance is against the law and can result in hefty fines, imprisonment, and even license suspension.

Furthermore, relying on fake car insurance can leave you financially vulnerable and without proper coverage in the event of an accident or damage to your vehicle. It is always advisable to obtain genuine car insurance from a reputable provider to ensure your safety and comply with legal requirements.

Credit: www.bankrate.com

Understanding Car Insurance Fraud

Car insurance fraud is a serious offense that involves intentionally deceiving an insurance company to obtain financial benefits or to avoid paying premiums. This fraudulent activity can have severe consequences, including legal ramifications and financial loss for the parties involved. It is essential to understand the different types of car insurance fraud to protect yourself from becoming a victim.

What Is Car Insurance Fraud?

Car insurance fraud refers to any deliberate act of deception, misrepresentation, or dishonesty committed by an individual or group to gain financial advantages from an insurance company. These fraudulent activities can occur at various stages, including during the application process, claim submission, or property evaluation.

Types Of Car Insurance Fraud

1. Staged Accidents: Some individuals intentionally orchestrate accidents to file fraudulent claims against unsuspecting drivers or insurance companies. These staged accidents can involve colliding with another vehicle, intentionally causing property damage, or faking injuries to receive compensation.

2. False Claims: This type of fraud involves submitting false or exaggerated claims for vehicle damage or personal injuries. Individuals may overstate their losses, repair costs, or medical expenses to receive higher compensation than they are entitled to.

3. Premium Evasion: Premium evasion occurs when individuals provide false information or misrepresent their circumstances to pay lower insurance premiums. This could involve providing inaccurate vehicle details, manipulating their driving records, or failing to disclose previous claims or accidents.

4. Identity Fraud: Identity fraud involves using someone else’s information, such as their name or address, to obtain car insurance policies or file claims. Perpetrators of identity fraud often target individuals with clean driving records to receive better rates or avoid suspicion.

It is important to note that car insurance fraud is illegal and can lead to criminal charges, hefty fines, and increased insurance premiums for those involved. Being knowledgeable about the various types of fraud can help protect yourself and your insurance provider from falling victim to these deceitful practices.

Credit: justt.ai

The Risks And Penalties Of Fake Car Insurance

Having car insurance is not just a legal requirement, but also a crucial safeguard against unforeseen accidents and financial liabilities. However, some individuals may be tempted to fake car insurance for various reasons, such as saving money or avoiding scrutiny. While it may seem like a quick solution, the risks and penalties of doing so far outweigh any possible benefits. In this article, we will explore the legal and financial consequences of fake car insurance, shedding light on why it is essential to maintain genuine coverage.

Legal Consequences

Attempting to fake car insurance is a serious offense that can have severe legal ramifications. When caught, individuals may face substantial penalties imposed by both state and federal authorities. These penalties may include:

- Steep fines and monetary penalties

- License suspension or revocation

- Criminal charges, which can result in a permanent criminal record

- Potential imprisonment depending on the jurisdiction and severity of the offense

The consequences of fake car insurance can extend beyond personal penalties. If involved in an accident without legitimate coverage, the responsible party could be held personally liable for damages and injuries suffered by others. This can lead to significant financial burden and even bankruptcy in some cases.

Financial Consequences

Faking car insurance may seem like a way to save money in the short term, but the long-term financial consequences can be devastating. Here are some potential financial risks associated with fake car insurance:

- Uncovered damages and medical expenses: In the event of an accident, individuals with fake insurance risk having to pay for the damages and medical expenses out of pocket. This can easily amount to thousands or even tens of thousands of dollars.

- Increased insurance premiums: If caught faking car insurance, obtaining genuine coverage in the future can become challenging and expensive. Insurance providers often view those with a history of fraudulent behavior as high-risk, resulting in substantially higher premiums.

- Legal fees and court costs: If involved in legal proceedings due to fake insurance, individuals may be required to pay for attorney fees and other court-related expenses. These costs can quickly escalate and add significant financial strain.

- Loss of assets: In extreme cases, individuals with fake insurance may be forced to liquidate their assets to compensate for the damages and legal liabilities incurred. This can result in financial ruin and a loss of personal property.

Given the severe legal and financial consequences of faking car insurance, it is clear that this is not a path worth pursuing. It is always in one’s best interest to maintain legitimate coverage, ensuring protection both for themselves and for others on the road. Remember, the potential risks of fake insurance far outweigh any perceived benefits.

How To Spot Fake Car Insurance

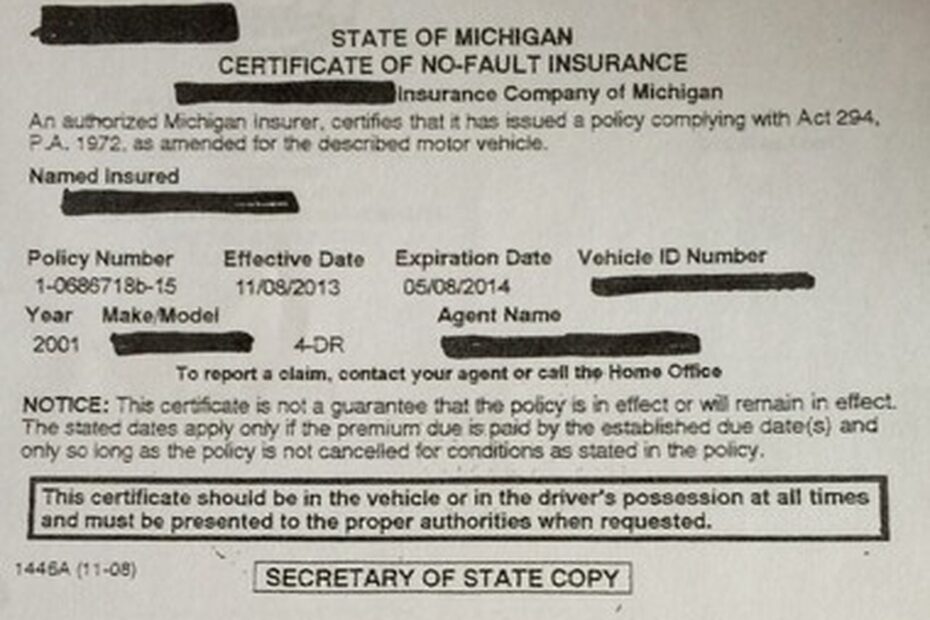

Fake car insurance can leave you vulnerable and exposed to financial risks in case of accidents or damages. It’s essential to be able to identify signs of fake insurance to protect yourself. In this section, we will explore some red flags to watch out for and provide a method to verify the authenticity of your car insurance with the insurance company.

Check For Red Flags

When examining your car insurance documents, watch out for the following red flags:

- Misspellings or grammatical errors in the policy details or contact information.

- Inconsistencies in the formatting and layout of the documents.

- Unrealistically low premiums compared to the average market rates.

- Lack of a valid insurance company logo or contact information.

- No policy number or a suspiciously short policy number.

- Unprofessional or poorly designed insurance cards or documents.

- Mismatched or outdated information on the insurance documents compared to your actual vehicle details.

Verify With The Insurance Company

Once you have identified potential red flags in your car insurance documents, it’s crucial to verify the authenticity with the insurance company. Follow these steps:

- Locate the contact information of the insurance company, such as their official website or their customer service hotline.

- Reach out to the insurance company and provide them with your policy details, including the policy number, your name, and any other necessary information.

- Ask the insurance company to validate and confirm the authenticity of your car insurance policy.

- Listen carefully to the response from the insurance company, paying attention to any discrepancies or conflicting information.

- If the insurance company confirms that your policy is indeed valid, you can rest assured that your car insurance is legitimate. However, if they indicate any issues or inconsistencies, it’s crucial to take immediate action to rectify the situation.

Consequences Of Using Fake Car Insurance

Using fake car insurance may seem like a quick solution to avoid expensive premiums, but it can have severe consequences. It is essential to understand the potential risks involved before considering such actions. Below, we outline three major consequences that could impact your financial stability and legal standing.

Denial Of Claims

One of the significant risks of using fake car insurance is the denial of claims in case of an accident or damage to your vehicle. Insurance companies thoroughly investigate claims to verify their authenticity, and if they discover that you provided fraudulent information, they can refuse to honor your claim. This means you would be responsible for covering the entire cost of repairs or medical expenses, leaving you in a precarious financial situation.

Increase In Premiums

Another consequence of using fake car insurance is the subsequent increase in your future premiums. Insurance companies consider fraudulent activity as a breach of trust, and they may view you as a high-risk policyholder. As a result, they can raise your premiums significantly, making it more difficult for you to afford legitimate coverage in the future. The short-term benefits of fake insurance could lead to long-term financial strain.

Suspension Of Driver’s License

Using fake car insurance can also result in the suspension of your driver’s license. Driving without valid insurance is illegal in most jurisdictions, and if you are caught, you may face severe penalties. In addition to fines and legal consequences, your license could be suspended, restricting your ability to drive legally. It is important to prioritize your safety and comply with the law by maintaining valid and legitimate car insurance.

Tips To Avoid Fake Car Insurance

If you’re in the market for car insurance, it’s important to be cautious and avoid falling victim to scams or fake insurance providers. To help you navigate the process, here are some important tips to keep in mind:

Research The Insurance Provider

Before purchasing car insurance, it’s crucial to thoroughly research the insurance provider to ensure their legitimacy. Look for information such as their license number, customer reviews, and ratings from reputable sources. This will give you a better understanding of the company’s reputation and reliability.

Purchase From Licensed Agents

One way to avoid fake car insurance is to purchase from licensed agents or brokers. Licensed agents are regulated by authorities and are required to operate within specific guidelines. By working with a licensed agent, you can have peace of mind knowing that you’re dealing with a legitimate insurance provider.

Review Policy Documentation

When purchasing car insurance, it’s important to carefully review the policy documentation provided by the insurance company. Pay attention to the terms, coverage details, and any exclusions mentioned in the policy. This will help you ensure that you’re getting the coverage you need and that the policy aligns with your expectations.

By following these tips, you can protect yourself from falling victim to fake car insurance scams. Remember, it’s always better to be cautious and do your due diligence before making any financial commitments.

Credit: www.ramseysolutions.com

Frequently Asked Questions For How To Fake Car Insurance

What Is The Penalty For Fake Insurance?

Committing car insurance fraud by using fake proof of insurance carries steep penalties, including fines, jail time, and an increase in auto insurance rates. Using fake insurance is a crime with serious consequences.

Is Auto Insurance A Real Thing?

Auto insurance is a real thing that helps pay for injuries and damages in car accidents. It’s important to compare policies and make informed decisions when purchasing auto insurance.

How To Print Insurance Policy Online?

To print your insurance policy online, follow these steps: 1. Visit your insurer’s official website. 2. Login to your account using your policy details. 3. Look for the option to download the policy document. 4. Click on the download button. 5.

Print the downloaded document. Remember to keep your login details and policy number handy for a smooth process.

Can I Insure A Car I Don’t Know?

Yes, you can insure a car you don’t know. It depends on your insurance provider and their guidelines. You may be able to add your name to the car’s title or purchase non-owner liability insurance.

Conclusion

Using fake car insurance is not only illegal but also comes with severe consequences. It can lead to penalties such as fines, jail time, and increased auto insurance rates. It is important to remember that auto insurance is meant to protect you in case of accidents and damages.

Rather than trying to fake car insurance, it is advisable to obtain legitimate coverage that will provide you with the necessary protection.

- How to Diagnose Bad Strut Mounts: Expert Tips for Quick Fixes - May 16, 2024

- How to Bypass Blower Motor Relay: 7 Expert Techniques - May 16, 2024

- How to Easily Check Ecu Ground: Essential Steps for Optimal Performance - May 16, 2024