If accident damage exceeds your car insurance, you may be held personally liable for the remaining costs that exceed your policy limits, resulting in a deficiency judgment. This means you will have to pay the additional amount out of your own pocket.

Credit: www.thezlawfirm.com

Understanding Car Insurance Coverage

If the damage from an accident exceeds your car insurance coverage, you may be personally liable for the remaining costs. In this situation, you could face a deficiency judgment, where you owe the amount exceeding your insurance policy limits.

Car insurance is an essential protection that provides coverage for financial losses due to accidents or damages to your vehicle. It is crucial to understand the different types of car insurance coverage and their importance to ensure you have adequate protection in the event of an accident. Let’s delve into the details:

What Is Car Insurance?

Car insurance is a contract between you and an insurance company that protects you financially in case of an accident or damage to your vehicle. It provides coverage for medical expenses, property damage, and liability claims.

Types Of Car Insurance Coverage

There are various types of car insurance coverage available. The most common ones include:

- Liability coverage: This type of coverage pays for the damage you cause to others’ property or injuries sustained by other people in an accident you are responsible for.

- Collision coverage: Collision coverage pays for the damages to your vehicle caused by a collision with another vehicle or object, regardless of fault.

- Comprehensive coverage: Comprehensive coverage protects your vehicle against non-collision damages, such as theft, vandalism, fire, or natural disasters.

- Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who has insufficient or no insurance coverage.

- Medical payments coverage: Medical payments coverage helps pay for medical expenses resulting from an accident, regardless of who is at fault.

Importance Of Car Insurance Coverage

Having adequate car insurance coverage is crucial for several reasons:

- Financial protection: Car accidents can result in significant financial losses. Car insurance coverage ensures that you are protected and not burdened with hefty repair bills or medical expenses.

- Legal requirements: In many states, car insurance is legally required. Driving without insurance can lead to fines, license suspension, or even legal trouble.

- Peace of mind: Knowing that you have proper car insurance coverage gives you peace of mind while driving, as you are protected against unexpected events.

In conclusion, understanding car insurance coverage is essential for every vehicle owner. It ensures financial protection, legal compliance, and peace of mind. Make sure to review your policy and choose the appropriate coverage to safeguard yourself and your vehicle.

What Happens If Accident Damage Exceeds Your Car Insurance?

When the damage from an accident exceeds your car insurance coverage, you may be personally liable for the remaining costs. This can result in a deficiency judgment, where you are responsible for the amount exceeding your insurance policy limits.

Coverage Limits And Liability

When it comes to car insurance, it’s important to understand your coverage limits and liability. Your car insurance policy will specify the maximum amount the insurance company will pay for damages resulting from an accident. If the damage exceeds this coverage limit, you may be personally liable for the remaining amount.

Insurance Company Liability

If the judgment from an accident exceeds your car insurance policy limits, the insurance company is responsible for paying the entire judgment, including the amount that exceeds the coverage limit. This means that the insurance company will be liable for the excess amount, and you won’t be held personally responsible for paying it.

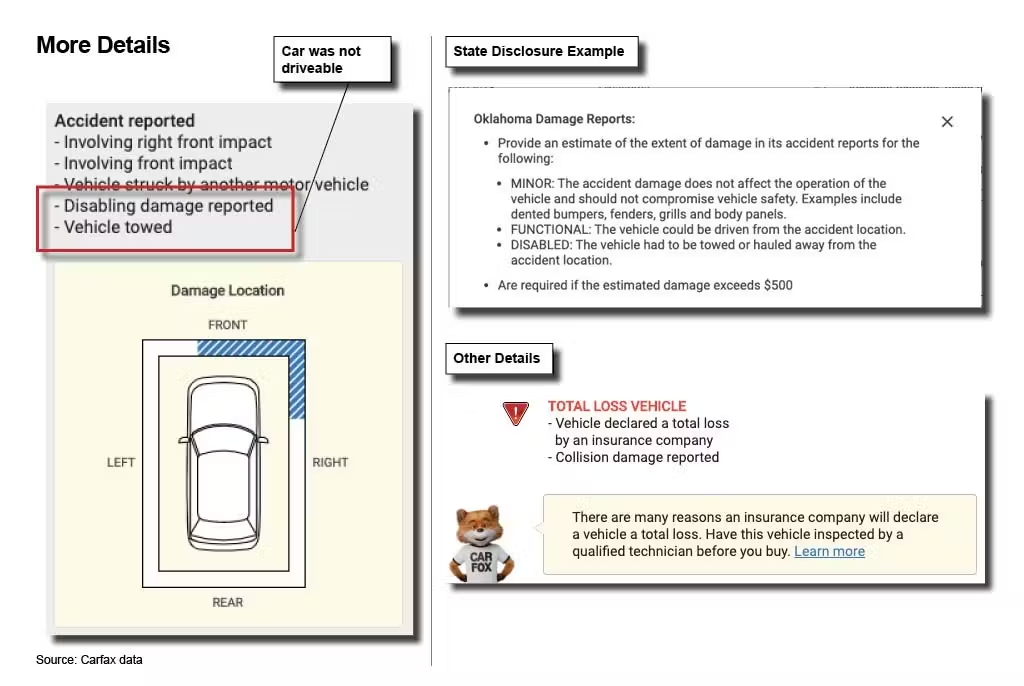

Declaring A Vehicle As A Total Loss

When the cost to repair the damage exceeds the value of your vehicle, the insurance company will declare your car a total loss. This means they will reimburse you for the current market value of your car rather than paying for the repairs. It’s important to note that this value may be lower than the amount you initially paid for the car.

Remaining Cost Of Treatment

If the damages from an accident exceed your car insurance policy limit and you’re faced with medical bills that surpass the at-fault driver’s coverage, you may be responsible for paying the remaining cost of your treatment yourself. This situation can lead to a financial burden, as you’ll need to cover the shortfall out of your own pocket.

Impact On Car Insurance Premium

If the damage from an accident exceeds your car insurance coverage, you may face personal liability and be responsible for paying the remaining costs. Your insurance company will only cover up to the policy limits, and any amount exceeding that will have to be paid out of pocket.

Effect Of At-fault Accidents

When you are involved in an accident and it is determined that you are at fault, there are several consequences that you may face. One of the most significant impacts is the effect it will have on your car insurance premium. Insurance companies consider at-fault accidents as a sign of increased risk, which leads to an increase in insurance rates.

Potential Increase In Insurance Rates

After an at-fault accident, it is highly likely that your insurance rates will increase. Insurance companies use a variety of factors to calculate premiums, and an at-fault accident is a major red flag. The increase in rates is a way for the insurance company to cover the increased risk associated with insuring a driver who has a history of causing accidents. The exact increase will depend on several variables, including the severity of the accident, the amount of damage caused, and your previous driving history.

Credit: www.frplegal.com

Legal Implications In Texas

When it comes to car accidents, it’s essential to understand the legal implications, especially if the accident damage exceeds your car insurance coverage in Texas. In Texas, if someone sues you for an amount that surpasses your insurance policy limits, you may face personal liability. This situation can potentially lead to a deficiency judgment – a debt calculated as the excess claim amount minus your liability insurance policy limits.

Facing Personal Liability

If you find yourself in a situation where the accident damage exceeds your car insurance coverage, you may face personal liability. This means that you may be personally responsible for the remaining amount of the claim beyond your policy limits. It’s crucial to remember that the insurance company is generally only liable for the damages up to the coverage limit stated in your policy.

Possibility Of Deficiency Judgment

A deficiency judgment can occur in Texas when the amount awarded in a lawsuit is higher than your liability insurance policy limits. Essentially, it means that there is a shortfall between your insurance coverage and the actual damages awarded. The remaining amount, called the deficiency, becomes a debt that you are responsible for paying. It’s important to note that deficiency judgments can have significant financial consequences and should be taken seriously.

In conclusion, if the accident damage exceeds your car insurance coverage in Texas, you may face personal liability and the possibility of a deficiency judgment. This emphasizes the importance of thoroughly understanding your insurance policy limits and ensuring that you have adequate coverage to protect yourself in the event of an accident.

Options For Exceeding Insurance Coverage

If you find yourself in a situation where the damage from an accident exceeds your car insurance coverage, there are a few options you can consider to address the remaining amount. It’s important to understand these options to ensure you are prepared in case such a situation arises.

Insurance Claim Exhausts Liability Coverage

If your insurance claim exhausts your liability coverage and there is still a remaining amount to be paid, you may face personal liability for the excess. In Texas, for example, if someone sues you for an amount exceeding your insurance coverage, you may be held personally responsible for the remaining debt. This can result in what is known as a deficiency judgment.

A deficiency judgment is calculated by subtracting your liability insurance policy limits from the claim amount. It is important to be aware of the potential for personal liability in these circumstances and understand the financial implications it may have.

Personal Liability For Remaining Amount

When your car insurance coverage is not sufficient to cover the full extent of the damages, you may be responsible for the remaining amount out of pocket. This means you will have to pay the excess cost of repairs or medical bills yourself.

Dealing with the personal liability for the remaining amount can be challenging, especially if it exceeds your financial means. It is important to carefully consider your options and explore possible solutions to mitigate the impact of this financial burden.

One option could be to negotiate a settlement with the injured party or their insurance company, depending on the circumstances of the accident. Another option may be to set up a payment plan to manage the remaining debt over time. Exploring these possibilities can help alleviate some of the financial stress.

It’s important to note that in certain situations, the at-fault party’s insurance may also come into play to cover the remaining amount. However, this will depend on the specifics of the accident and the insurance policies involved.

In conclusion, when accident damage exceeds your car insurance coverage, it can lead to personal liability for the remaining amount. Understanding your options and finding ways to address the excess cost is crucial to protect your financial well-being. Consider consulting an attorney or insurance professional to guide you through the process and help you make informed decisions.

Credit: www.carfax.com

Frequently Asked Questions For What Happens If Accident Damage Exceeds Your Car Insurance

Who Pays The Damages That Exceed The Policy Limits?

If the damages exceed the policy limits, the insurance company is responsible for paying the entire judgment, including the amount in excess of the policy limits.

What Happens When Damage Is More Than Car Is Worth?

If the damage to your car exceeds its worth, your insurer will declare it a total loss. They will not cover the repairs if they cost more than the car’s value.

What Happens To Excess Bills From A Car Accident Once You Ve Gone Over Your Maximum Coverage Limit?

If your car accident damages exceed your maximum coverage limit, your insurance company is only liable for the amount within the policy limits. You may be responsible for paying the remaining cost of your treatment or repairs yourself.

Does Accidental Damage Increase Insurance?

Accidental damage can increase insurance rates. If the cost of repairs exceeds the value of the car, the insurer may declare it a total loss. The insurance company is liable for damages that exceed policy limits. However, in some states, premiums may not increase if the damage is below a certain dollar amount.

Conclusion

In the unfortunate event that the damage from an accident exceeds your car insurance coverage, there are a few things to keep in mind. Firstly, your insurance company will only be responsible for paying up to the policy limits. If the damages exceed these limits, you may be personally liable for the remaining amount.

This could potentially lead to a deficiency judgment, where you are held responsible for paying the claim amount beyond your insurance coverage. It’s crucial to consider the potential financial implications and ensure you have sufficient coverage to protect yourself in such situations.

- How to Diagnose Bad Strut Mounts: Expert Tips for Quick Fixes - May 16, 2024

- How to Bypass Blower Motor Relay: 7 Expert Techniques - May 16, 2024

- How to Easily Check Ecu Ground: Essential Steps for Optimal Performance - May 16, 2024