Getting into a car accident without insurance in Florida can lead to serious consequences, including license and registration suspension and potential difficulty with future car insurance rates.

Consequences Of Driving Without Insurance

Driving without insurance in Florida is not only illegal but can lead to significant consequences. If you are involved in a car accident without insurance, you may face various penalties and financial liabilities. Some of the key consequences of driving without insurance in Florida include:

Suspension Of License And Registration

When you get into a car accident without insurance in Florida, the Department of Highway Safety and Motor Vehicles (DHSMV) can suspend your driver’s license and vehicle registration. This means that you will no longer be legally allowed to drive or operate your vehicle on the road. The suspension of your license and registration can have a major impact on your daily life, making it challenging to commute to work or handle daily responsibilities.

Impact On Car Insurance Rates

If you drive without insurance and get into an accident, it can significantly impact your car insurance rates in the future. Insurance companies consider driving without insurance as a high-risk behavior, and as a result, they may view you as a higher insurance risk. This can lead to increased premiums or difficulties in finding affordable car insurance coverage. It is important to note that even if the accident was not your fault, driving without insurance can still result in higher insurance rates.

Financial Liability In An Accident

Driving without insurance means that you are personally responsible for any damages or injuries that result from an accident. This can include expenses related to property damage, medical bills, and legal fees. If the accident was your fault, you may be liable for the damages caused to the other party involved in the accident. Without insurance, you may face significant financial burden and potential lawsuits if you are unable to pay for these expenses out of pocket. It is crucial to have insurance coverage to protect yourself and others in case of an accident.

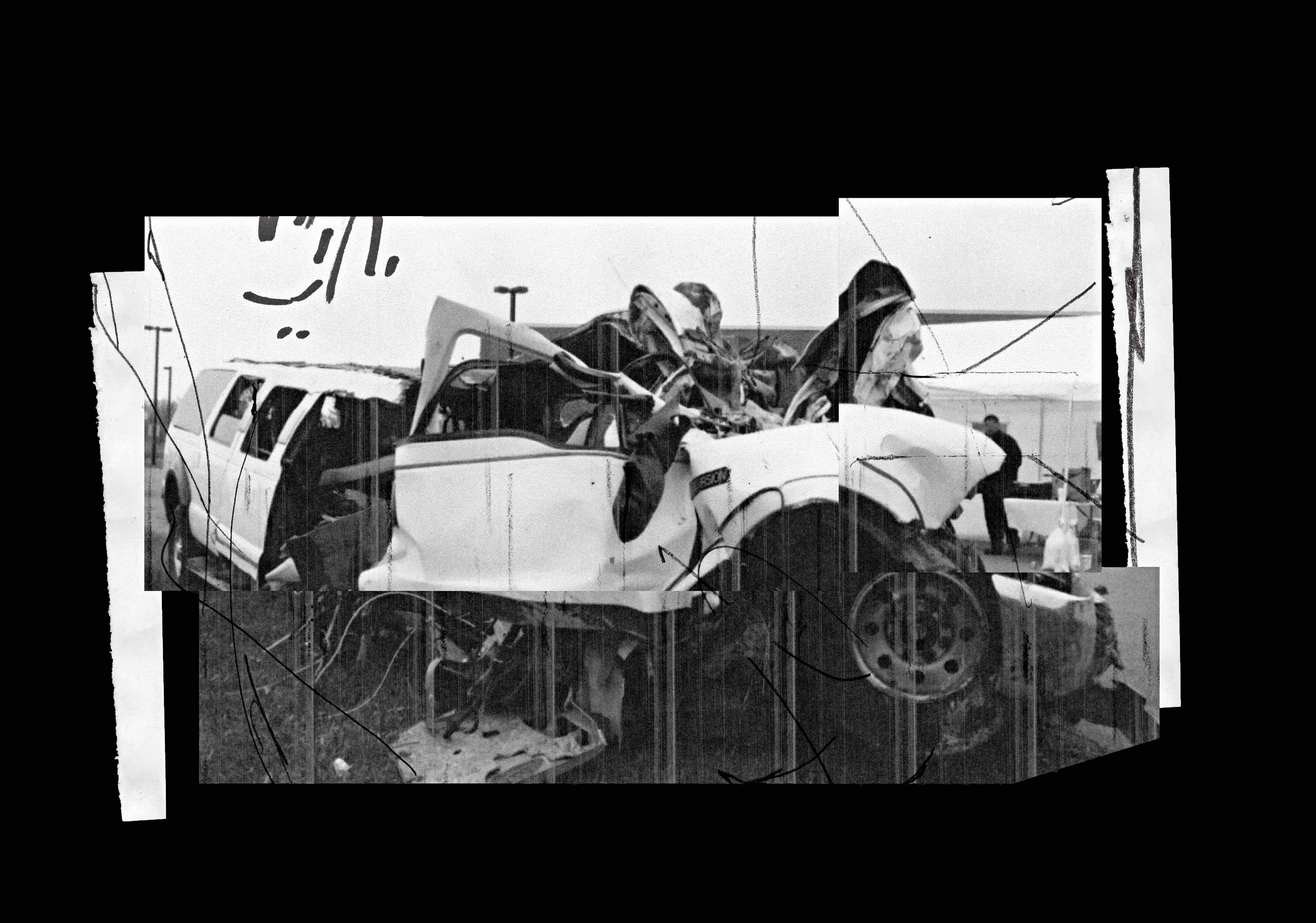

Credit: nymag.com

No-fault Laws And Auto Repair Coverage

Understanding the laws and coverage options related to auto repair after a car accident is crucial, especially if you find yourself involved in an accident without insurance in Florida. Florida’s no-fault laws and auto repair coverage play a significant role in determining who bears the financial responsibility for the damages incurred. Let’s take a closer look at how these factors affect your situation.

Florida’s No-fault Laws

In Florida, the concept of no-fault insurance means that each driver’s insurance company pays for their respective policyholder’s medical expenses, regardless of who caused the accident. This also applies to auto repair coverage. If you are involved in a car accident and you do not have insurance, you might assume that the other driver’s insurance will cover the damages. However, since Florida’s no-fault laws usually require each party to rely on their own insurance, things can get complicated without coverage.

Coverage For Auto Repair After An Accident

If you cause an accident and do not have insurance, you will likely be held personally responsible for the auto repair costs. However, if the accident was not your fault and you are uninsured, your options for seeking compensation are limited. Under Florida’s no-fault system, your insurance will cover your auto repair expenses up to the limit of your policy, even if you were not at fault. But, if the costs of the damages exceed your policy limits, you might need to explore other avenues for recovering additional compensation.

One possible option is to pursue a claim against the at-fault driver’s insurance company directly. However, if the other driver is uninsured or underinsured, this can make the process more challenging. Consulting with an experienced personal injury attorney can help you navigate these complex situations and explore all possible avenues for recovering the compensation you deserve.

Recovering Additional Compensation

If you are involved in a car accident without insurance in Florida, recovering additional compensation can be difficult. However, it is not impossible. To increase your chances of recovering additional compensation, it is important to gather evidence to support your claim, such as photographs of the accident scene, witness statements, and police reports.

Once you have gathered the necessary evidence, consulting with a personal injury attorney is crucial. They can help you determine if you have grounds for a lawsuit against the at-fault driver, explore any available insurance coverage, and guide you through the legal process to recover the compensation you deserve.

While being involved in a car accident without insurance in Florida can be daunting, understanding the no-fault laws, coverage for auto repair, and options for recovering additional compensation can help alleviate some of the stress. Remember, consulting with a personal injury attorney is always a wise decision to ensure you receive the rightful compensation for the damages you have incurred.

Legal Options For Uninsured Accidents

If you get into a car accident without insurance in Florida, you may not go to jail, but you could face other consequences like license suspension and higher insurance rates in the future. Your insurance may cover property damage if you have collision coverage, but if the costs exceed your policy limits, you may be able to seek additional compensation.

Suing An Uninsured Driver In Florida

If you have been involved in a car accident in Florida and the at-fault party does not have insurance, you may wonder what legal options are available to you. One option is to sue the uninsured driver for damages. While it can be challenging to collect compensation from an uninsured driver, it is not impossible. By taking the right steps and obtaining legal representation, you may be able to recover the compensation you deserve.

Hit By An Uninsured Motorist

If you have been hit by an uninsured motorist in Florida, you may be eligible to make a claim through your own insurance company. Florida law requires drivers to carry uninsured motorist coverage, which helps protect you in situations where the at-fault party does not have insurance. This coverage can help you recover medical expenses, lost wages, and other damages resulting from the accident.

When The At-fault Party Doesn’t Have Insurance

When the at-fault party in a car accident does not have insurance, it can make the process of seeking compensation more challenging. However, there are still options available to you. In these cases, it may be necessary to turn to other sources of compensation, such as your own insurance policy or potentially filing a lawsuit against the at-fault party. Consulting with an experienced car accident attorney can help you understand the best course of action in your specific situation.

Consequences And Penalties

Getting into a car accident without insurance in Florida can have severe consequences and penalties. It is essential to understand the potential outcomes if you find yourself in this situation. The Florida Department of Highway Safety and Motor Vehicles (DHSMV) takes driving without insurance seriously and imposes strict penalties to deter individuals from driving uninsured.

License Suspension

One of the immediate consequences of getting into a car accident without insurance in Florida is the suspension of your driver’s license. The DHSMV will suspend your license as well as your vehicle registration, plate, and tags unless you provide proof of insurance within a specified time frame.

Revocation Or Suspension Of Driver’s License

In addition to the suspension of your license, Florida law allows for the revocation or suspension of your driver’s license. The severity of this penalty depends on the circumstances surrounding the accident and whether it is your first offense or a repeat offense. If your license is revoked, you will be required to go through the process of reapplying for a new license once the revocation period has expired.

Financial Consequences And Liability

Aside from the loss of your driving privileges, there are also significant financial consequences and liabilities associated with getting into a car accident without insurance in Florida. Without insurance, you will be personally responsible for covering the costs of any damages or injuries resulting from the accident. This includes repairs to your own vehicle, medical expenses for yourself and others involved in the accident, and any potential legal fees if the other party decides to sue you for damages.

The financial burden of an uninsured car accident can be substantial and may have long-lasting effects on your financial well-being. Additionally, if you are found at fault for the accident and are unable to pay for the damages, you may face additional legal consequences, including potential wage garnishment or attachment of assets.

It is important to remember that driving without insurance is not only illegal but also puts you at significant risk. It is always best to have proper insurance coverage to protect yourself and others in the event of an accident. Taking the necessary precautions and abiding by the law can save you from the severe consequences and penalties associated with driving uninsured.

What To Do In A Car Accident Without Insurance

In the unfortunate event that you are involved in a car accident without insurance in Florida, it is crucial to report the accident to the authorities as soon as possible. Reporting the accident helps create an official record of the incident and can be important for legal purposes later on. Contact the local police department and provide them with all the necessary details about the accident, including the date, time, location, and any injuries or damages sustained. Be honest and cooperative with the police to facilitate a smooth process.

If you find yourself in a car accident without insurance, it is advisable to seek legal advice from a reputable attorney specializing in personal injury or car accidents. A knowledgeable lawyer can guide you through the legal process and help protect your rights. They can assess the circumstances of the accident, evaluate your potential liability, and provide guidance on the best course of action. Consult with a lawyer as soon as possible to understand your options and navigate the complexities of the legal system.

While you may not have insurance at the time of the accident, it is still important to explore potential insurance coverage options. In some cases, there may be alternative sources of coverage available to compensate for injuries or damages. For example, if the accident was caused by another party, you may be able to seek compensation through their insurance policy. Additionally, if you were a passenger in someone else’s vehicle or riding a bicycle or motorcycle, you may be eligible for coverage under their insurance policy. Consult with an experienced attorney to explore all possible avenues for insurance coverage and determine the best course of action.

Credit: m.facebook.com

Credit: www.bankrate.com

Frequently Asked Questions For What Happens If You Get Into A Car Accident Without Insurance In Florida

Can You Go To Jail For No Insurance In Florida?

No, you cannot go to jail for driving without insurance in Florida. However, you may face consequences such as license and registration suspension. It is illegal to drive without insurance, and it can also impact your future car insurance rates.

Will My Insurance Go Up If The Accident Wasn T My Fault Florida?

In Florida, if the accident wasn’t your fault, your insurance rates may not go up. However, your insurance company may still raise your rates due to other factors. It’s important to review your policy and discuss with your insurance provider.

Who Pays For Car Damage In Florida No-fault?

Your insurance company will pay for car damage in Florida’s no-fault system. However, if the damage exceeds your policy limits, you may be eligible to seek additional compensation elsewhere.

Can You Sue An Uninsured Driver In Florida?

Yes, you can sue an uninsured driver in Florida. However, even if you win the lawsuit, it may be challenging to collect compensation without insurance coverage. It is advisable to consult with a lawyer to explore your legal options.

Conclusion

If you get into a car accident without insurance in Florida, you may face dire consequences. While you won’t go to jail, your license and registration may be suspended. Additionally, driving without insurance can have a long-term impact on your car insurance rates.

It is important to always have proper insurance coverage to protect yourself and others on the road. Don’t take risks, prioritize insurance and stay on the right side of the law.